Designs By Dave O.A Full-Service Website Development Agency

Our Services

Delivering solutions from web design and development to robust digital marketing strategies

- EWebsite Design & Development

- EE-Commerce

- EGoogle Ads

- EMembership & Subscription

- ESearch Engine Optimzation

- EWebsite Management

- EWebsite Hosting

- EApp Development

- EAI Consulting

- ECopywriting

- EEmail Marketing

- ESocial Media Marketing

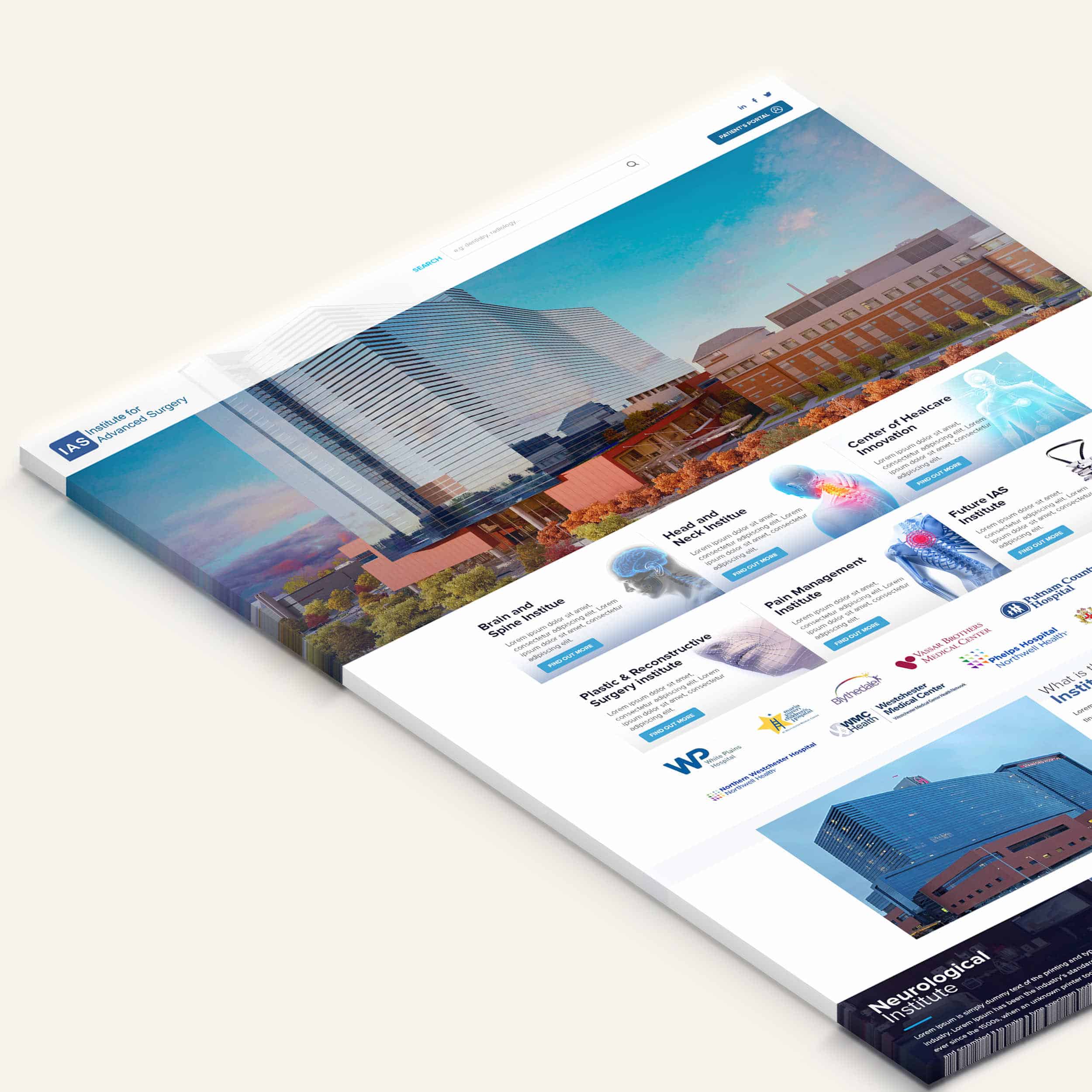

Featured Website Work

Effortless Process, Innovative Concepts, Remarkable Outcomes

Our Process

Effortless Process, Innovative Concepts, Remarkable Outcomes

01

Discover

We initiate our design process by engaging in effective communication to understand your business objectives and goals, shaping a strategy to elevate your brand. Following this, we meticulously craft a project plan and timeline, delivering an innovative design infused with futuristic technology.

02

Strategize

Following comprehensive research, we establish the foundation of the plan by creating a wireframe and prototype. This outlines essential functionalities, key structures, and features for your business project. We prioritize collaborative efforts, seeking client approval at ekey stages of the project.

03

Design

Working closely with our creative team, we strategize essential content, focusing on its value to customers. Our collaborative effort includes deciding optimal content placement to drive conversions and foster sustainable business growth.

04

Develop

With your business goals and input at the forefront, our company employs custom human-facing elements, visual graphics, and cutting-edge technology to breathe life into your brand. This approach ensures an exceptional user experience

05

Deliver

With careful attention to detail and a commitment to excellence, we deliver your project, ensuring it exceeds your expectations. Experience the satisfaction of seeing your ideas transform into reality with our seamless process, innovative concepts, and extraordinary outcomes.

Let's Connect!

Client Shout Outs

Artificial Intelligence

Elevate Your Business with AI-Powered Transformations

Our tailored AI for business services is designed to enhance efficiency, uncover actionable insights, and position your company at the forefront of the evolving digital landscape.

- ELegal

- EInsurance

- EFinance

- EEducation

- EHealthcare

- EReal Estate

- EAdvertising

- EHuman Resources

Recent Posts

What is Google Business Manager?

Brand Messaging: Connecting with Your Users